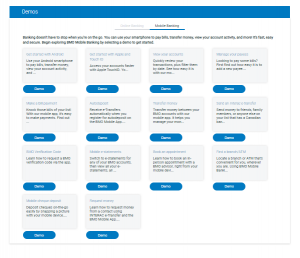

The tech tool that I have decided to review is the BMO Digital Banking Demo. I hope to use this to support my teaching of financial literacy. I used all of the questions we generated in the discussion forum and reach my conclusion.

This tool would be suitable to break up the unit and offer students bite-size and personalized demos to students. 93% of students I teach currently use online banking and only 43% use it for more than checking their balance. By showing students how to set up payments, download statements or change their address in a secure and private setting, it will give skills the confidence to do this themselves with their own online banking when the time comes. Likewise, the focus would be on developing confidence to manage their finances so reaffirming how to check for balances, monitor payments and change dates as well as setting up regular payments (for savings) will help offer students some potential strategies for the future.

Evaluation

- Does the tech need additional plug-ins – eg Java? NO

- Is there a way for the students to use the tech outside of the class if they miss the class, or do they have to be in class to use the tech? They can access the demo anytime providing they are connected to the internet.

- Is the tech ready to use, or does it require individual student accounts and a class account? Ready to go- just a simulation so no sign in required.

- Do the students need a lot of support before they can use the tech independently? No, they follow the red circle and follow the ‘walk through’ simulation’

- Does the tech activity need to be completed in one session, or can it be broken down into shorter sections? There are 26 demos for online banking and 14 for mobile banking so these can be spread across the unit or particular demos selected according to the learning objectives and needs of the class.

- If it is a simulation, is it possible to speed it up or slow it down? The user follows the red circles and controls the pace.

- Does the digital tool allow students to use their school email address to sign up? No email address or sign up needed.

- Does the digital tool allow students to save/import or embed their work? Students could use Screen Castify to capture their participation in using the tool.

- Does the digital tool allow students to develop transferable skills? Yes. Self-awareness (selecting demos appropriate to own needs).

- Does the digital tool allow students to engage in authentic, real-world learning? Yes It shows students what the app looks like, how it works and guides them through real-life examples. This is safer than using a ‘live’ bank account.

- Does the digital tool allow students to manage their own account? N/A

- Does the digital tool allow students to collaborate/Network with others? No.

- Is the technology savable? No progress shown. Students could use Screen Castify or take snips for evidence of use.

- Is the sign-up easy? No sign up needed.

- Is it user friendly? Simple to use and easy to follow the red circles.

- Is it age appropriate? Yes.

- Are there clear learning outcomes? Yes. It states:

- Is the tool adaptable for different learners? No. The screen can be increased for visually impaired and the language can be changed to french.

- Is it a one time tool or can it be used multiple times? Unlimited use

- -Is it time effective? Yes. Each demo is really short.

- Is the tool safe for the age group? Yes. Simulation only and no sign up or personal needed needed.

- Does the tool support targeted learning outcomes? Yes. Students to develop confidence in using tools to manage their finances.

- Is the tool accessible to all instructors and learners? Yes. Visually impaired can make the web page larger, language can be changed to French. Designed for visual learners. Can be self-paced.

- Does the tool cost money to use, and if so, how much. Free.

- Does the tool require users to create accounts, and if so, does this process meet privacy guidelines. No sign up required.

- What instruction or training is necessary to use this tool. None. Follow the red circles to complete the ‘walk through’ demo.

- Does it promote inclusion? Combination of visuals and text. Coloured circle. Easy to read font with readable interface.

- How to justify or design its use for meeting goals and objectives in an Individual Education Plan? Yes. Free to use, self-paced and allows students to practice accessing tools to manage their finances without offering up personal information. Safe and appropriate to age.

- How to verify accuracy/reliability of info? If there is no school or district criteria, how to ensure this? No. Comes from BMO so an official organisation. Scanning through the info, there is nothing political or bias. Factual info demonstrating a process.

- Is there equitable/fair access for all. Access to the internet required.

- What if a child/student does not have access to a computer. Unable to use this interactive demo.

- What if they do not have a social media account? (parents won’t allow, don’t have a device..etc). Not needed.

- Has safe use of internet social media been considered. Yes. N/A

- How much pedagogical knowledge/understanding is required for safe/effective use of the technology/media – None. Self explanatory- follow the red circles and it guides you through the virtual demo.

- What are the professional development opportunities around this? N/A Teachers will want to scan through the interface first in case it differs from their online banking institution.

- How can it be managed and controlled by educators. No sign up required, no politics or bias. Could check to see if other banks provide these tools and compare.

- If a student decides to explore a question or conceal further, how does the educator remain involved. There are a total of 40 different demos. If a student selects a question that is not on the demo, the teacher can support the student to locate this information elsewhere.

- How to ensure fairness in assessment when someone students have had more exposure, practice and experience than others when it comes to using technology and media. N/A students will be selecting the demos that are relevant to their use and so will not be compared against others. This isn’t measuring a product but understanding of a process.

Thanks for the review Sarah

With the inclusion of financial literacy in the new Math curriculum, this will be very useful.

Thanks

Jim

Hi Sarah,

These are great tutorials. I have a friend who does financial literacy training in First Nations contexts and she has talked about how she can really walk the learners through some of the most important issues with a few online tools.

Thank you for posting

Hi, I found a cool method of penis enlargement, here https://bit.ly/2N4bBAl

дали дали песня

песня про

музыка 2021 новинки слушать

давай песню

группы песнь

песни бесплатно mp3

музыка mp3 бесплатно качество

слушать онлайн песнь

скачать музыку 2021

песни лета 2021 года

лучшие песни онлайн

музыка mp3

скачать музыку с вк

слушать музыку остановка

слушать песнью

песня просто

музыка песни

лучшие песни слушать онлайн

mp3 бесплатно

бесплатная популярная музыка 20201

скачать музыку на телефон

суть песни

песни онлайн бесплатно в хорошем качестве

музыка mp3

нова песня

качество песни

музыка mp3 бесплатно качество

лучшие песни слушать бесплатно

лучший песнь

какая песня

песня видео

песни онлайн бесплатно в хорошем качестве

музыка вк

песни 2021 года

песни слушать бесплатно

скачать песню бывшая

песня дай дай дам дам

скачать песню мп3

скачать хорошие песни mp3

новинки русской музыки

измены

бдсм

скачать музыку бесплатно 2021

песня ея ея ея

mp3 скачать 2021

песня мама

mp3 музыка 2021

новинки музыки 2021 скачать бесплатно

слушать музыку новинки

найти песню

музыка бесплатно 2021

песня мама

музыка на телефон бесплатно

музыка без слов

лучшие песни онлайн бесплатно

песня руки

песни группы

русская музыка 2021

mp3 качество скачать

суть песни

перевод песни

песни лета 2021

включи песню

бесплатные новинки mp3

музыка онлайн бесплатно

скачать mp3 в хорошем качестве

песни 2021 года

песня рождения

слушать популярную музыку онлайн

музыка на телефон бесплатно

бесплатные песнь

музыка остановка

песнь песней скачать

поешь песню

бесплатно mp3 все песни в хорошем песни

мп3 скачать бесплатно

mp3 скачать качество бесплатно

бесплатные новинки mp3

музыка 2021 слушать

скачать музыку бесплатно на телефон

песнь года

лучшие песни

skachat mp3

популярные песни

музыка бесплатно

The images are too small to see them. You can post them on Instagram and gain followers from https://soclikes.com/buy-instagram-followers to more people be able to know info on pictures.

скачать музыку на телефон

музыка хиты

скачать песни mp3

песни 2021 года

бела бела песня

музыка на звонок

скачать песнь 2021

песни 2021 года

музыка без остановок онлайн бесплатно

музыка самая самая

песни черных

лучшие песни слушать бесплатно

скачать песню мп3

хорошая музыка

слушать песни качестве бесплатно

текст песни

музыка 2021 новинки слушать

музыка песнь

песни 2021

популярная музыка онлайн

песнь года

Tanhu; İthalat ve İhracat Seçenekleri ile, Toptan ve Perakende, İhtiyacınız Olan Ürünleri Tedarik Edeceğiniz En İyi Şirket ve Güvenilir Alışveriş Ortamı.!Tanhu; Toptan ve Perakende Alışveriş İçin, En Doğru Adres. Gönül Rahatlığıyla Alışveriş Yapabileceğiniz, Yeni Nesil Güvenilir Bir Alışveriş Platformu.!

google buy hacklink services instagram.

музыка в машину

скачать mp3

слушать музыку онлайн бесплатно 2021

новая песнь

песня танцуй

музыка 2021 без

музыка онлайн 2020

слушать музыку без остановки

google buy hacklink services instagram.

скачать песни mp3

музыка без слов

mp3 бесплатно

песни бесплатно в хорошем качестве

слушать музыку онлайн бесплатно

песнь песней слушать онлайн бесплатно

музыка mp3 хорошее качество

песни бесплатно

слушать песни онлайн

популярная музыка 2021 слушать

песня девочка

скачать музыку бесплатно на телефон

google buy hacklink services instagram.

слушать песни в хорошем качестве

музыка вк

музыка mp3 хорошее качество

песня тока тока

слушать музыку онлайн бесплатно 2021

песнь песней слушать онлайн бесплатно

новинки музыки

яндекс музыка

песня видео

музыка самая самая

музыка 2021 слушать бесплатно

лучшие песни слушать онлайн

песня давай давай даю даю

скачать музыку с вк

скачать песнь

скачать музыку новинки

слушать русскую музыку бесплатно

скачать песни в хорошем качестве

слушать музыку

слушать музыку остановка

хостинг фотографий

google buy hacklink services tiktok.

google buy hacklink services youtube and social media.

google buy hacklink services instagram and social media.

google buy hacklink services facebook and social media.

this web site best buy hacklink services and twitter and tiktok services.

Консультация психолога

https://dom5min.ru/zhilety-s-logotipom.html

Помощь в получении ипотеки

твич накрутка

Do you want to make video about it for tiktok? I read from here https://timebusinessnews.com/why-should-you-include-views-for-tiktok-into-your-promotion/ how to get many tiktok views for any video

google buy Instagram hacklink services.

фільми онлайн тільки для українців

лордфильм онлайн взрослые фильмы 18+

google buy tiktok hacklink services.

https://t.me/chpokuz_tashkenta

Banggood Promo Code

An intriguing discussion is worth comment. There’s no doubt that that you should publish more

on this topic, it may not be a taboo matter but typically people don’t discuss these issues.

To the next! Cheers!!

Путешествуем по Крыму вместе, отдых на море в Крыму. Пляжи, экскурсии, путешествия и оздоровление. Море, солнце и пляж – где отдохнуть, что посмотреть в Крыму? Целебные озера, туристический и пляжный отдых на берегу моря, крымская кухня https://mytravelcrimea.ru/

Excellent weblog here! Additionally your site lots up very fast!

What web host are you the use of? Can I get your associate

link on your host? I wish my website loaded up as

fast as yours lol

google buy instagram hacklink services.

It is a very good post. If you want to promote it on twitter I advise you to buy twitter likes. It will make your promotion more successful

Buy Instagram followers, get instant delivery, and grow your brand We help you get real followers for your Instagram account, so you can reach a bigger audience.

buy facebook animal porn and watch sex, buy viagra.

имена, рифмы рифма к имени Юля

Модная одежда ведущих брендов

Сумки Tatonka

номер такси https://xn--80aqf2ac.taxi/

Best buy SEO services.

Услуги различной спецтехники: Успехспецтех Объявления Россия.

https://mcg1.ru/

Some genuinely wonderful info , Glad I found this.

https://ssss.ru

Шутки, те что поднимают настоящий хохот постоянного пользователя находяться здесь на развлекательном источнике демотиваторы кайфолог, который доступен неизменно специально для всякого желающего. На сайте Вы обретает в окружении пространства вполне увлекательного плюс реклаксичного ленты, какой посетитель сумеет настроить для свои доминантных выборкам. Под ваше интерес мы разработали очень главные странички, те что правильно перейдут у число индивидуальных отличий: анекдоты, комичные рассказы, эротические фото, автомобили или мотики, мировые факты, знаменитости, насмешки, увлекательные месседжы и иные описания, какие посетители будут получать реакции, сохранять, обсуждать также пересылать знакомыми.

Получить вход на нашем сайт достаточно понятно – быстрая ввод данных личного кабинета разрешает быть настоящим плюс главным читателем данного https://ruera.ru/ разработаного онлайн-сайта. Каждый момент мы снабжают собранную приличную сайт самыми современными также эффектными фотографиями, статьями также картинками, поэтому можем заручаемся, то что каждодневная лента в данный момент полностью содержательна и полезна!

такия песня

песни круга

музыка 2021 новинки слушать

слушать популярную музыку онлайн

алиса песни

слушать песни бесплатно в хорошем качестве

buy xbox game pass with bitcoin

мп3

новинки mp3

слушать музыку без остановки

песнь песней слушать

всея музыка

новинки mp3

mp3 2021 скачать бесплатно

музыка mp3 бесплатно качество

скачать песню мп3

слушать музыку бесплатно без остановки

слова песни

качество музыки mp3

скачать новинки музыки 2021

Купить Преформ Пива оптом

https://avenue17.ru/oborudovanie/bu/emkosti-iz-nerzhavejuschej-stali

Hello to every body, it’s my first pay a visit of this web site;

this weblog carries remarkable and genuinely fine information in favor of visitors.

https://gamesell.ru/gkey/2899365

Wow, wonderful weblog layout! How lengthy have you ever been running

a blog for? you made running a blog look easy. The overall

look of your web site is great, let alone the content material!

Pretty part of content. I just stumbled upon your

web site and in accession capital to say that I get in fact enjoyed account your

weblog posts. Anyway I’ll be subscribing to your feeds or even I fulfillment you get admission to persistently

rapidly.

What’s Taking place i am new to this, I stumbled upon this I have discovered It positively helpful and it

has helped me out loads. I’m hoping to contribute & assist different users like its aided me.

Great job.

https://gamesell.ru/gkey/3109319

If you would like to increase your know-how only keep visiting this site and

be updated with the most up-to-date news update posted

here.

Excellent post. I will be dealing with a few of these issues as well..

I used to be suggested this website by means of my cousin. I’m not certain whether or not this put up

is written by way of him as nobody else realize such special about my problem.

You’re wonderful! Thanks!

Hi there, its pleasant paragraph about media print, we all be aware of media is a

great source of data.

Yesterday, while I was at work, my cousin stole my iphone and tested to see if it can survive a thirty foot drop, just

so she can be a youtube sensation. My apple ipad is now broken and

she has 83 views. I know this is entirely off topic but I had

to share it with someone!

https://gamesell.ru/gkey/1888724

I have read so many posts concerning the blogger lovers but this paragraph is truly a fastidious article,

keep it up.

Hi! I understand this is sort of off-topic however I had to ask.

Does managing a well-established website such as yours require a

lot of work? I am completely new to writing a blog however I do write in my journal everyday.

I’d like to start a blog so I will be able to share my own experience and views online.

Please let me know if you have any kind of recommendations or tips for new aspiring blog owners.

Appreciate it!

Have you ever thought about writing an e-book or guest authoring on other sites?

I have a blog based on the same ideas you discuss and would love to have you share some stories/information. I know my readers would enjoy your work.

If you are even remotely interested, feel free to send me

an e-mail.

hey there and thank you for your info – I’ve definitely picked up

anything new from right here. I did however expertise some technical points using this

web site, since I experienced to reload the web site many times previous

to I could get it to load correctly. I had been wondering if your web host is OK?

Not that I am complaining, but slow loading instances times will sometimes affect your placement in google and could damage your high quality

score if ads and marketing with Adwords. Well

I am adding this RSS to my e-mail and could look out for much

more of your respective fascinating content. Make sure you update this again very soon.

Hi there everybody, here every person is sharing such familiarity, thus it’s good to read this webpage, and I used to visit this

webpage everyday.

No matter if some one searches for his essential thing, thus he/she wishes to be available that in detail, therefore that thing is maintained

over here.

This design is steller! You certainly know how to keep a reader amused.

Between your wit and your videos, I was almost moved to start my own blog (well,

almost…HaHa!) Excellent job. I really enjoyed what you had to say,

and more than that, how you presented it. Too cool!

Настройка таргетированной рекламы (качество превыше всего) Мои услуги: 1.Подготовка посадочных страниц ( сайт или Instagram страница); 2.Детальное изучение ниши; 3.Создание креативов (видео, картинка или слайд шоу-карусель); 4.Анализ конкурентов; 5.Выявление Целевой аудитории и создание Lookalike аудитория https://rostyslav.com/

Very shortly this web site will be famous amid all blogging and site-building people,

due to it’s nice articles or reviews

فالوور ایرانی واقعی https://bit.ly/3g5FB9L

I love your blog.. very nice colors & theme. Did you create this

website yourself or did you hire someone

to do it for you? Plz reply as I’m looking to construct my own blog and would like to

know where u got this from. thanks a lot

Very rapidly this website will be famous among all blogging users, due

to it’s nice content

I’m gone to inform my little brother, that he should also visit this blog

on regular basis to obtain updated from most up-to-date reports.

I am really happy to glance at this blog posts which includes plenty of valuable facts, thanks

for providing such data.

Do you mind if I quote a couple of your articles as long as I provide credit and

sources back to your webpage? My blog is in the exact same niche as yours and my visitors would

certainly benefit from a lot of the information you present here.

Please let me know if this ok with you. Thanks!

Piece of writing writing is also a fun, if you know after that

you can write or else it is complex to write.

Great post. I was checking constantly this weblog and

I’m inspired! Very useful information specifically the ultimate phase 🙂 I maintain such information much.

I was looking for this particular information for a long time.

Thanks and good luck.

It’s actually a nice and helpful piece of information. I am glad that you

just shared this helpful info with us. Please keep us informed like this.

Thank you for sharing.

Wow that was unusual. I just wrote an incredibly long comment but after

I clicked submit my comment didn’t appear. Grrrr…

well I’m not writing all that over again. Anyways, just wanted to say fantastic blog!

Hello there, I found your web site via Google even as looking for a

comparable subject, your website came up, it seems good.

I’ve bookmarked it in my google bookmarks.

Hi there, simply changed into aware of your weblog

via Google, and located that it is really informative. I am gonna watch out for brussels.

I’ll appreciate if you happen to proceed this in future.

Numerous other people will probably be benefited from

your writing. Cheers!

Very good blog! Do you have any helpful hints for

aspiring writers? I’m planning to start my own site soon but I’m a little lost on everything.

Would you advise starting with a free platform like WordPress or go

for a paid option? There are so many options out there that I’m completely confused ..

Any recommendations? Thanks!

Hey there would you mind sharing which blog platform you’re working with?

I’m going to start my own blog in the near future but

I’m having a tough time deciding between BlogEngine/Wordpress/B2evolution and Drupal.

The reason I ask is because your layout seems different then most blogs

and I’m looking for something unique. P.S Apologies

for getting off-topic but I had to ask!

Hey there! I’ve been following your website for some time now and

finally got the bravery to go ahead and give you

a shout out from Humble Texas! Just wanted to tell you keep up the great work!

I enjoy, lead to I found exactly what I used to be having a look for.

You have ended my four day long hunt! God Bless you man. Have a great day.

Bye

Its like you read my thoughts! You seem to understand so much about this, such as you wrote

the e-book in it or something. I feel that you just can do

with some % to force the message home a little bit,

however instead of that, that is great blog. A great read.

I will definitely be back.

Nice blog here! Also your web site loads up very fast!

What host are you using? Can I get your affiliate link to your host?

I wish my site loaded up as fast as yours lol

Ridiculous quest there. What occurred after? Thanks!

I know this if off topic but I’m looking into starting my own blog

and was curious what all is needed to get setup? I’m

assuming having a blog like yours would cost a pretty penny?

I’m not very internet smart so I’m not 100% certain. Any suggestions or advice would be greatly appreciated.

Appreciate it

We are a group of volunteers and starting a new scheme in our community.

Your web site offered us with valuable information to work on. You have

done an impressive job and our whole community will be grateful to you.

I’m not sure where you’re getting your information, but good topic.

I must spend a while learning more or figuring out more. Thanks

for magnificent info I used to be searching for this information for my mission.

Hi! I just wanted to ask if you ever have any trouble with

hackers? My last blog (wordpress) was hacked and I ended up

losing several weeks of hard work due to no back up.

Do you have any methods to prevent hackers?

Thanks for any other excellent article. The place

else could anybody get that kind of info in such an ideal manner of writing?

I’ve a presentation subsequent week, and I am at the search for such

information.

After study a number of the web sites for your site now, i really such as your strategy for blogging.

I bookmarked it to my bookmark website list and will be checking back soon.

Feel free to visit my website: 텍사스홀덤사이트

I wanted to say Appreciate providing these details, you’re doing a great job with the site…

파칭코사이트인포

The information you are providing that is really good. Thank for making and spending your precious time for this useful information. Thanks again and keep it up. | 슬롯머신777사이트

Hey there, You’ve done an excellent job. I will definitely dig it and personally suggest to my friends. I’m confident they will be benefited from this website.

Click here: 블랙잭사이트

Hey there are using WordPress for your blog platform? I’m new to

the blog world but I’m trying to get started and create my own. Do you need any coding

expertise to make your own blog? Any help would be really appreciated!

Thank you for the auspicious writeup. It in truth used to be a enjoyment account

it. Look complex to more delivered agreeable from you!

However, how could we be in contact?

Hey there excellent website! Does running a blog similar to this take

a massive amount work? I’ve very little expertise in computer programming however I was hoping to start

my own blog in the near future. Anyway, if you have any ideas or tips

for new blog owners please share. I understand this is off topic but I simply had

to ask. Appreciate it!

Currently it sounds like Drupal is the top blogging platform available right now.

(from what I’ve read) Is that what you are using on your blog?

I’m impressed, I must say. Seldom do I come across a blog that’s both equally educative and engaging, and let me

tell you, you have hit the nail on the head. The problem is something that not

enough folks are speaking intelligently about.

Now i’m very happy that I found this during my search for something

concerning this.

Have you ever thought about adding a little bit more than just your articles?

I mean, what you say is fundamental and everything.

Nevertheless think about if you added some great visuals or video clips to give your posts more,

“pop”! Your content is excellent but with pics and video clips, this site could definitely be one of the most beneficial in its field.

Very good blog!

With havin so much written content do you ever run into any problems of plagorism or copyright infringement?

My blog has a lot of unique content I’ve either created myself

or outsourced but it looks like a lot of it is popping it up all over the web without my agreement.

Do you know any techniques to help protect against content from being ripped off?

I’d really appreciate it.

whoah this blog is fantastic i love reading your articles.

Keep up the good work! You recognize, many individuals

are looking round for this information, you could aid them greatly.

https://bit.ly/2RQ3FFG tnx for best artical

I have been exploring for a bit for any high quality articles or weblog posts in this sort of area .

Exploring in Yahoo I eventually stumbled upon this site.

Studying this information So i am satisfied to express that I have an incredibly good uncanny feeling

I found out exactly what I needed. I such a lot unquestionably will

make certain to do not forget this site and provides it a glance on a relentless basis.

What’s up to every , for the reason that I am really

eager of reading this weblog’s post to be updated daily.

It includes nice data.

It’s very easy to find out any matter on web as compared to textbooks, as I found this paragraph at this web site.

This is my first time pay a quick visit at here and i am

really happy to read everthing at single place.

Undeniably believe that which you stated. Your favorite justification seemed to be on the web the easiest thing to be aware of.

I say to you, I definitely get irked while people consider

worries that they plainly don’t know about. You managed to hit the nail upon the top as well as defined out the

whole thing without having side effect , people can take a signal.

Will probably be back to get more. Thanks

Hi there to all, how is everything, I think every one is getting more from this web page, and

your views are pleasant in support of new viewers.

If you want to obtain a good deal from this post then you

have to apply these strategies to your won webpage.

Hi, Neat post. There’s a problem together with your web site

in internet explorer, could check this? IE still is the marketplace leader and

a large component of other folks will miss your

fantastic writing because of this problem.

hi!,I really like your writing so much! share we communicate more about your article on AOL?

I require a specialist on this area to unravel my problem.

May be that’s you! Taking a look forward to peer you.

My partner and I stumbled over here from a different website and thought I might as well check

things out. I like what I see so now i am following you.

Look forward to checking out your web page repeatedly.

This blog was… how do I say it? Relevant!!

Finally I have found something which helped me. Cheers!

Wonderful, what a website it is! This weblog provides helpful facts

to us, keep it up.

https://t.me/kharidfollowerinstgram

I like the valuable information you provide in your articles.

I’ll bookmark your blog and check again here frequently.

I am quite certain I will learn a lot of new stuff right here!

Best of luck for the next!

Hi there Dear, are you really visiting this site daily, if so after that you will without doubt obtain pleasant know-how.

What’s Taking place i’m new to this, I stumbled upon this I have found It absolutely

useful and it has helped me out loads. I am hoping to contribute & assist different users like its helped me.

Good job.

Ahaa, its nice conversation concerning this article at this place at this blog, I have read all that,

so at this time me also commenting here.

Good post. I learn something totally new and challenging

on blogs I stumbleupon every day. It will always be interesting to

read content from other writers and practice something from their sites.

I’m gone to inform my little brother, that he should also pay a visit this web site on regular basis to obtain updated from most

recent reports.

I know this site provides quality based articles or reviews and additional

stuff, is there any other website which gives these kinds of data in quality?

Just want to say your article is as astonishing.

The clarity in your put up is just excellent and

i could assume you’re a professional on this subject.

Fine with your permission let me to clutch your feed to stay up to date with forthcoming post.

Thank you one million and please continue the enjoyable work.

I’m really enjoying the theme/design of your website. Do you

ever run into any internet browser compatibility issues?

A couple of my blog audience have complained about

my blog not working correctly in Explorer but

looks great in Chrome. Do you have any solutions to help fix

this problem?

Article writing is also a fun, if you be familiar with then you can write if not it is complex to write.

Thank you for the good writeup. It in fact was a amusement account it.

Look advanced to far added agreeable from you!

By the way, how could we communicate?

Woah! I’m really loving the template/theme of this blog.

It’s simple, yet effective. A lot of times it’s very hard to

get that “perfect balance” between user friendliness and visual appeal.

I must say that you’ve done a great job with this.

Additionally, the blog loads very quick for me on Safari.

Excellent Blog!

Its such as you read my mind! You appear to know a lot

approximately this, like you wrote the ebook in it

or something. I believe that you just can do with a few %

to drive the message home a little bit, but instead of that, that is

excellent blog. A fantastic read. I will definitely be back.

Thanks , I have just been searching for information approximately this topic for a long time and yours is the

greatest I have found out so far. However, what concerning

the conclusion? Are you positive about the source?

My brother suggested I might like this web site. He was entirely right.

This post actually made my day. You can not imagine just how much time I had spent for this information!

Thanks!

I am regular reader, how are you everybody?

This paragraph posted at this web page is really fastidious.

If some one wishes to be updated with newest technologies then he must be visit this

web site and be up to date every day.

You should be a part of a contest for one of the best sites on the net.

I am going to highly recommend this website!

Have you ever thought about creating an ebook or guest

authoring on other sites? I have a blog centered on the same

information you discuss and would really like to

have you share some stories/information. I know my viewers would enjoy your work.

If you’re even remotely interested, feel free to shoot me an email.

I think this is one of the most important info for

me. And i’m glad reading your article. But wanna remark on some general things, The site

style is wonderful, the articles is really nice :

D. Good job, cheers

It’s very simple to find out any topic on web as compared to books, as I found this piece

of writing at this web site.

I blog often and I really thank you for your content.

Your article has truly peaked my interest. I am going to take a

note of your blog and keep checking for new details about once per week.

I subscribed to your RSS feed as well.

Fastidious answers in return of this query with genuine arguments and describing all about that.

Greetings from Florida! I’m bored at work so I decided to check out your site on my iphone during

lunch break. I enjoy the info you present here and can’t wait to take a look when I get home.

I’m surprised at how quick your blog loaded on my cell phone ..

I’m not even using WIFI, just 3G .. Anyhow, wonderful blog!

Greetings I am so delighted I found your web site, I really

found you by mistake, while I was searching on Aol for something else, Regardless I am here

now and would just like to say thank you for a remarkable post and a all round exciting blog (I also love

the theme/design), I don’t have time to read it all at the moment

but I have saved it and also included your RSS feeds, so when I have

time I will be back to read a lot more, Please do keep up the fantastic jo.

I am regular reader, how are you everybody?

This article posted at this website is genuinely nice.

I was suggested this web site by my cousin. I’m not sure

whether or not this put up is written via him as no one else recognize such

unique about my problem. You are wonderful! Thanks!

I am curious to find out what blog system you have been utilizing?

I’m having some minor security issues with my latest website

and I’d like to find something more safeguarded. Do you have any recommendations?

Hello Dear, are you truly visiting this site regularly, if so afterward you

will definitely take fastidious knowledge.

Excellent beat ! I would like to apprentice while you amend your web site, how can i subscribe

for a blog site? The account aided me a acceptable deal. I had been tiny bit acquainted of this your broadcast offered bright clear idea

Wow, fantastic weblog layout! How lengthy have you been blogging for?

you made running a blog look easy. The full look of your website

is great, as well as the content!

Great post. I’m facing some of these issues as well..

Heya i’m for the first time here. I came across this board and I find It really useful & it helped me out much.

I hope to give something back and aid others like you aided me.

I would like to thank you for the efforts you’ve put in penning this

website. I’m hoping to view the same high-grade blog posts by you in the future as well.

In fact, your creative writing abilities has motivated me to get my own blog now

😉

Hi there, i read your blog from time to time and i own a similar one and i was just wondering

if you get a lot of spam comments? If so how do you prevent it, any

plugin or anything you can advise? I get so much lately

it’s driving me mad so any assistance is very much appreciated.

Hi everyone, it’s my first go to see at this website, and article is really fruitful designed for me, keep up posting these articles or reviews.

Thanx for aetq3

You’re so awesome! I don’t suppose I have read a single

thing like that before. So good to find somebody

with a few genuine thoughts on this subject. Really..

thank you for starting this up. This web site is something that’s needed on the internet,

someone with a bit of originality!

Excellent items from you, man. I’ve keep in mind your

stuff previous to and you are simply extremely fantastic.

I really like what you have acquired right here, really like what you’re stating

and the way in which by which you say it. You make it enjoyable and you continue to take care of to keep it smart.

I can’t wait to learn far more from you. This is really a terrific website.

In fact when someone doesn’t be aware of after that its up to other users that

they will assist, so here it happens.

My partner and I stumbled over here different web address

and thought I may as well check things out. I like what I see so

i am just following you. Look forward to going over your web page

again.

Great site you’ve got here.. It’s hard to find excellent writing like yours

nowadays. I truly appreciate individuals like you!

Take care!!

Thanks for sharing your thoughts on Element Vape Discount Code.

Regards

I used to be suggested this blog through my cousin. I’m now not

sure whether this publish is written by way of him as nobody else recognise such specific about my trouble.

You are amazing! Thanks!

Hi there to every body, it’s my first visit of this web site;

this web site carries awesome and actually good stuff for visitors.

I have been surfing on-line greater than 3 hours nowadays, yet I by no means

found any fascinating article like yours. It’s pretty worth

enough for me. Personally, if all website owners and bloggers made just

right content as you probably did, the web might be much

more useful than ever before.

We absolutely love your blog and find a lot of your post’s to be just what

I’m looking for. Does one offer guest writers to write content

for you personally? I wouldn’t mind publishing a post or elaborating on a number of the subjects you write in relation to here.

Again, awesome web log!

Aw, this was an incredibly good post. Spending some time and actual effort to create a top notch article…

but what can I say… I hesitate a whole lot and never manage to get anything done.

Hi! I’ve been reading your blog for some time now

and finally got the courage to go ahead and give you a shout out from Porter

Tx! Just wanted to say keep up the good work!

Hello to all, because I am genuinely keen of reading this weblog’s post

to be updated daily. It contains pleasant information.

Appreciating the time and energy you put into your site and in depth information you offer.

It’s nice to come across a blog every once in a while that isn’t the same unwanted rehashed material.

Fantastic read! I’ve bookmarked your site and I’m including your RSS feeds to my Google account.

Excellent article! We are linking to this great content on our

site. Keep up the good writing.

Ahaa, its fastidious discussion about this

article at this place at this website, I have read all that, so at this time me also commenting at

this place.

I’m not sure why but this web site is loading very slow for me.

Is anyone else having this issue or is it a issue on my end?

I’ll check back later on and see if the problem still exists.

Its like you read my mind! You seem to know a lot about this, like you wrote

the book in it or something. I think that you can do

with some pics to drive the message home a bit,

but instead of that, this is fantastic blog. A great

read. I will definitely be back.

Interesting blog! Is your theme custom made or did you download it

from somewhere? A design like yours with a few simple adjustements would really make my blog jump out.

Please let me know where you got your design. Thanks a

lot

Does your website have a contact page? I’m having a tough time locating it but, I’d like to shoot you an e-mail.

I’ve got some suggestions for your blog you might be interested in hearing.

Either way, great site and I look forward to seeing it grow over time.

Hi there, I discovered your web site via Google at the same time as looking for a comparable subject, your site came up, it seems to be great. I’ve bookmarked it in my google bookmarks.

https://master-climat.com.ua/

Wonderful post! We are linking to this great article on our website.

Keep up the great writing.

Write more, thats all I have to say. Literally, it seems as though you

relied on the video to make your point. You obviously know what

youre talking about, why waste your intelligence on just posting videos to your blog when you

could be giving us something enlightening to read?

Greetings I am so grateful I found your webpage,

I really found you by mistake, while I was researching

on Askjeeve for something else, Regardless I am here now

and would just like to say cheers for a tremendous post

and a all round exciting blog (I also love the theme/design), I don’t have time to read it all at the minute

but I have saved it and also added in your RSS feeds, so when I have time

I will be back to read much more, Please do keep up the excellent jo.

Hmm it appears like your website ate my first comment (it was extremely long) so I guess I’ll just sum it up

what I submitted and say, I’m thoroughly enjoying your blog.

I as well am an aspiring blog blogger but I’m still new to everything.

Do you have any tips for newbie blog writers?

I’d really appreciate it.

Wow, marvelous weblog layout! How long have you ever been blogging for?

you make running a blog glance easy. The entire look of

your website is wonderful, as neatly as the content material!

Aw, this was an exceptionally nice post. Taking a few minutes and actual effort to create a

top notch article… but what can I say… I hesitate a whole lot and don’t

manage to get nearly anything done.

Wow, this piece of writing is fastidious, my younger sister is analyzing

these kinds of things, therefore I am going to convey her.

Hey I know this is off topic but I was wondering

if you knew of any widgets I could add to my blog that

automatically tweet my newest twitter updates. I’ve been looking for a

plug-in like this for quite some time and was hoping maybe you would have some experience with something

like this. Please let me know if you run into anything.

I truly enjoy reading your blog and I look forward to your new updates.

We are a group of volunteers and opening a new scheme in our

community. Your site offered us with valuable information to work on. You have done an impressive job and

our whole community will be grateful to you.

Highly energetic blog, I enjoyed that a lot. Will there be a part

2?

Woah! I’m really loving the template/theme of this site.

It’s simple, yet effective. A lot of times it’s very difficult to get that “perfect balance” between usability and visual appearance.

I must say you’ve done a excellent job with this. Additionally, the

blog loads very quick for me on Internet explorer. Exceptional Blog!

My family all the time say that I am killing my time

here at net, but I know I am getting familiarity every day by reading

thes good articles.

https://irongamers.ru/sale/key/3031153

Appreciating the commitment you put into your website and in depth

information you present. It’s great to come across a

blog every once in a while that isn’t the same outdated rehashed information. Wonderful read!

I’ve saved your site and I’m including your RSS feeds to my Google account.

Hello! Do you know if they make any plugins to safeguard against hackers?

I’m kinda paranoid about losing everything I’ve worked hard

on. Any suggestions?

Hello my friend! I wish to say that this post is awesome, great

written and include approximately all significant infos.

I would like to see more posts like this .

Touche. Sound arguments. Keep up the amazing work.

Hey There. I found your weblog using msn. This is an extremely neatly written article.

I’ll be sure to bookmark it and come back to read extra of your useful information. Thanks for the

post. I’ll certainly comeback.

Hey There. I found your weblog the use of msn. That is a really smartly written article.

I will make sure to bookmark it and come back to learn extra of your helpful info.

Thank you for the post. I will definitely comeback.

It’s actually a nice and useful piece of info. I am glad that you just shared this helpful info

with us. Please stay us up to date like this.

Thanks for sharing.

It’s really very complex in this busy life to listen news

on Television, therefore I just use world wide web for that reason, and take the newest

news.

Hi there! This post couldn’t be written much better! Reading

through this article reminds me of my previous roommate!

He always kept talking about this. I most certainly will forward this information to him.

Fairly certain he’s going to have a very good read. Many thanks

for sharing!

Today, I went to the beach with my children. I found a sea shell and gave it to my 4 year old daughter and said “You can hear the ocean if you put this to your ear.” She

placed the shell to her ear and screamed. There was a hermit

crab inside and it pinched her ear. She never wants to go back!

LoL I know this is totally off topic but I had to tell

someone!

Excellent blog you have got here.. It’s hard to find high quality writing like yours nowadays.

I honestly appreciate people like you! Take care!!

Hi there! This post could not be written any better! Reading this post reminds me of my previous room mate!

He always kept chatting about this. I will forward this post to him.

Fairly certain he will have a good read. Thanks for sharing!

https://irongamers.ru/sale/key/3043219

Howdy! Do you use Twitter? I’d like to follow you if that would be

okay. I’m undoubtedly enjoying your blog and look forward to new updates.

This blog was… how do I say it? Relevant!! Finally I have found something which helped me.

Cheers!

Wonderful goods from you, man. I’ve understand your

stuff previous to and you’re just too excellent.

I really like what you have acquired here, certainly like what you

are stating and the way in which you say it. You make it

enjoyable and you still care for to keep it sensible.

I cant wait to read much more from you. This is actually a terrific site.

Wonderful, what a blog it is! This website provides helpful facts

to us, keep it up.

Nice blog! Is your theme custom made or did you download it from somewhere?

A design like yours with a few simple adjustements would

really make my blog jump out. Please let me know where you

got your design. Thanks a lot

You ought to be a part of a contest for one of the finest blogs on the

web. I am going to highly recommend this website!

You are so awesome! I don’t suppose I’ve read

through anything like that before. So wonderful to

discover someone with genuine thoughts on this issue.

Really.. thanks for starting this up. This site is one thing that is required on the internet, someone with

some originality!

Appreciate this post. Will try it out.

Heya i’m for the first time here. I came across this board and I find It really useful & it helped me out a lot.

I am hoping to present one thing back and help others such as you helped me.

I am sure this article has touched all the internet people, its

really really good piece of writing on building up new website.

This post is priceless. How can I find out more?

I do not even know how I ended up here, but I thought this post was good.

I do not know who you are but certainly you’re going

to a famous blogger if you aren’t already 😉 Cheers!

Hey I know this is off topic but I was wondering if you knew of any widgets I could add to my blog that

automatically tweet my newest twitter updates. I’ve been looking for a plug-in like this for quite some time and was hoping maybe you would have some experience with something like this.

Please let me know if you run into anything. I truly enjoy reading your blog and I look

forward to your new updates.

Hey I know this is off topic but I was wondering if you

knew of any widgets I could add to my blog that automatically tweet

my newest twitter updates. I’ve been looking for a plug-in like this

for quite some time and was hoping maybe you would have some experience with something like this.

Please let me know if you run into anything. I truly enjoy reading

your blog and I look forward to your new updates.

It’s an remarkable piece of writing for all the internet users; they will obtain advantage from it I am sure.

Excellent blog you have got here.. It’s hard to find high-quality writing like yours nowadays.

wholesale ethnics

Informative post.

Thanks for sharing with us.

Ethnics wholesale

Hello just wanted to give you a quick heads up and let you know

a few of the pictures aren’t loading properly. I’m not sure why but I think its a linking issue.

I’ve tried it in two different browsers and both show the

same outcome.

I absolutely love your website.. Pleasant colors & theme.

Did you make this web site yourself? Please reply back as I’m planning

to create my very own website and would love to find out where you got this from or exactly

what the theme is called. Kudos!

Greate pieces. Keep posting such kind of info on your blog.

Im really impressed by your blog.

Hey there, You’ve done a fantastic job. I will definitely

digg it and in my view recommend to my friends.

I’m sure they will be benefited from this web site.

Hi there Dear, are you actually visiting this website daily, if so after

that you will absolutely get fastidious experience.

Pretty portion of content. I just stumbled upon your blog and

in accession capital to say that I acquire actually enjoyed account your weblog posts.

Anyway I will be subscribing on your augment and even I fulfillment you get right of

entry to constantly rapidly.

If some one wants to be updated with latest technologies then he must be go to see this web page and be up to date all the time.

If some one needs expert view regarding blogging then i suggest him/her to visit this blog,

Keep up the nice job.

It’s going to be end of mine day, except before ending I am reading this wonderful paragraph to increase my

experience.

Thank you for the good writeup. It in fact was a amusement account

it. Look advanced to more added agreeable from you!

However, how could we communicate?

Thank you for the auspicious writeup. It in fact was a amusement account it.

Look advanced to more added agreeable from you! By the way, how can we communicate?

What’s up to all, for the reason that I am truly keen of reading

this web site’s post to be updated on a regular basis.

It carries fastidious data.

I know this website gives quality based content and additional material, is there any other site which offers such stuff in quality?

Hmm is anyone else experiencing problems with the images on this blog loading?

I’m trying to determine if its a problem on my end or if it’s the blog.

Any responses would be greatly appreciated.

I quite like reading through a post that will make men and women think.

Also, thanks for allowing for me to comment!

I don’t even understand how I stopped up

here, however I believed this post used to be good.

I do not recognise who you are but definitely you are going

to a famous blogger when you are not already. Cheers!

I do not even know how I ended up here, but I thought this post was good.

I do not know who you are but certainly you’re going to a famous blogger if you aren’t already 😉 Cheers!

Good web site you’ve got here.. It’s hard to

find excellent writing like yours these days. I seriously appreciate people like you!

Take care!!

Howdy would you mind stating which blog platform you’re using?

I’m going to start my own blog in the near future

but I’m having a hard time deciding between BlogEngine/Wordpress/B2evolution and Drupal.

The reason I ask is because your design and style seems different then most blogs and I’m looking for something

completely unique. P.S My apologies for getting off-topic

but I had to ask!

I think this is one of the most significant info for me.

And i’m glad reading your article. But want to remark on some general things, The site

style is perfect, the articles is really great : D. Good job, cheers

Hi there! This article could not be written any better!

Reading through this article reminds me of my previous roommate!

He continually kept preaching about this. I am going to send

this information to him. Fairly certain he’s going to have a very good read.

Thanks for sharing!

Wow, this paragraph is pleasant, my sister is analyzing

such things, thus I am going to convey her.

excellent issues altogether, you simply gained a new reader.

What may you suggest in regards to your submit that you simply made a few days

in the past? Any certain?

obviously like your web site however you have to check the spelling

on several of your posts. A number of them are rife with spelling problems and I find it very bothersome to inform the reality however

I will certainly come again again.

Hey! Do you use Twitter? I’d like to follow you if that would be okay.

I’m absolutely enjoying your blog and look forward

to new updates.

Hello, constantly i used to check blog posts here early in the daylight, because i love to gain knowledge of

more and more.

I’m really impressed with your writing skills as well as with the layout on your blog.

Is this a paid theme or did you customize it yourself?

Either way keep up the nice quality writing, it’s rare to see a

nice blog like this one today.

When someone writes an paragraph he/she retains the image of a user in his/her mind that how a user can be aware

of it. Therefore that’s why this piece of writing is perfect.

Thanks!

Great blog here! Also your website loads up fast!

What host are you using? Can I get your affiliate link

to your host? I wish my web site loaded up as fast as yours lol

Hi to all, how is all, I think every one is getting more from this website,

and your views are nice designed for new users.

Hello there! Do you use Twitter? I’d like to follow you if that would be okay.

I’m absolutely enjoying your blog and look forward to new posts.

I absolutely love your website.. Pleasant colors &

theme. Did you create this amazing site yourself?

Please reply back as I’m wanting to create my very own blog and

would love to learn where you got this from or just what the theme is called.

Many thanks!

I just like the valuable information you provide to your articles.

I’ll bookmark your weblog and take a look at again right here

regularly. I am fairly sure I’ll be informed

a lot of new stuff proper here! Good luck for the following!

Pretty nice post. I simply stumbled upon your weblog and wanted to mention that I’ve truly enjoyed

surfing around your blog posts. In any case I will be

subscribing to your rss feed and I am hoping you

write again soon!

I loved as much as you will receive carried out right here.

The sketch is attractive, your authored material stylish.

nonetheless, you command get bought an impatience over that you

wish be delivering the following. unwell unquestionably

come more formerly again as exactly the same nearly very often inside case you shield

this hike.

Hello there! Do you use Twitter? I’d like to follow you if that would be ok.

I’m undoubtedly enjoying your blog and look forward to new posts.

Excellent way of explaining, and pleasant post to take data regarding my

presentation focus, which i am going to present in school.

Fantastic items from you, man. I have understand your stuff previous to and you’re

simply extremely fantastic. I actually like what you

have obtained right here, really like what you’re saying and the best way wherein you are saying it.

You’re making it enjoyable and you continue to

care for to keep it smart. I cant wait to read much more from

you. This is actually a terrific website.

My family every time say that I am killing my time here

at web, but I know I am getting familiarity daily by reading thes fastidious articles or reviews.

This post is worth everyone’s attention. Where can I find out more?

Today, I went to the beach with my children. I found a sea shell and gave it to my 4

year old daughter and said “You can hear the ocean if you put this to your ear.” She placed the shell to her

ear and screamed. There was a hermit crab inside and it pinched her ear.

She never wants to go back! LoL I know this is entirely off topic but I had to tell someone!

Highly descriptive blog, I enjoyed that bit. Will there be a part 2?

Having read this I thought it was extremely enlightening.

I appreciate you spending some time and energy to put this short article

together. I once again find myself personally spending way too much time

both reading and leaving comments. But so what, it was still worth it!

I really love your website.. Very nice colors & theme.

Did you develop this site yourself? Please reply back as I’m wanting to create my own personal blog and would

love to know where you got this from or what the theme is called.

Cheers!

خرید فالوور

Asking questions are really pleasant thing if you are not understanding

something entirely, however this piece of writing presents good understanding yet.

Hello I am so glad I found your weblog, I really found you by accident,

while I was researching on Google for something else, Anyways I

am here now and would just like to say cheers for a incredible post and a all round entertaining blog (I also love

the theme/design), I don’t have time to browse it all at the minute but I have book-marked it and also added your RSS feeds, so when I have time I will be back to read more, Please do keep up

the awesome work.

I visited multiple sites however the audio quality for audio

songs present at this website is really excellent.

I will right away seize your rss feed as I can’t in finding your e-mail subscription hyperlink or newsletter service.

Do you have any? Kindly permit me know so that I may subscribe.

Thanks.

What’s up, yup this piece of writing is really pleasant and

I have learned lot of things from it concerning blogging.

thanks.

خرید فالوور

Its like you learn my thoughts! You seem to understand a lot about this, such as you wrote the book in it or something.

I believe that you simply can do with some percent to force the message

house a bit, but instead of that, this is excellent blog.

A great read. I’ll definitely be back.

Hello there! Do you know if they make any plugins to safeguard against

hackers? I’m kinda paranoid about losing everything I’ve worked hard on. Any

tips?

Appreciation to my father who shared with me concerning this blog, this blog is genuinely remarkable.

Hello to every , for the reason that I am truly eager of

reading this website’s post to be updated daily. It carries good stuff.

I think everything posted made a great deal of sense. But, what about this?

what if you were to create a killer post title?

I am not saying your content isn’t good, however what if you added a headline that makes people desire more?

I mean EDDL 5111 Blog Post #4 Application of the Checklist – Sarah Cook’

s EDDL Portfolio is kinda plain. You ought to look at Yahoo’s home page and watch

how they write post headlines to grab people interested.

You might add a related video or a related picture or two to grab readers interested about everything’ve written. Just my opinion, it could bring your website a little bit more interesting.

First of all I would like to say wonderful blog!

I had a quick question that I’d like to ask if you do not mind.

I was interested to know how you center yourself and clear your

mind prior to writing. I have had a hard time clearing my thoughts in getting my thoughts out there.

I truly do enjoy writing but it just seems like the first 10 to 15 minutes

are wasted just trying to figure out how to begin. Any recommendations or tips?

Many thanks!

Usually I do not read article on blogs, but I would like to say that this write-up very forced me to try and do so! Your writing style has been surprised me. Thanks, quite nice post.

Ahaa, its nice conversation regarding this post here at this website,

I have read all that, so at this time me also commenting at this

place.

of course like your web site however you have to test the spelling on several of your

posts. Many of them are rife with spelling issues and I to

find it very troublesome to tell the reality nevertheless

I’ll surely come back again.

I am really inspired with your writing talents as neatly

as with the layout for your blog. Is that this a paid

theme or did you customize it your self? Anyway keep up the excellent quality writing, it’s

rare to look a great blog like this one today..

WOW just what I was searching for. Came here by searching for 우리카지노

I have read so many posts regarding the blogger lovers however this piece of writing is really a nice post, keep it up.

Hello! I’ve been following your web site for a while now and finally got the courage

to go ahead and give you a shout out from Lubbock Texas!

Just wanted to mention keep up the great job!

Do you mind if I quote a few of your articles as long

as I provide credit and sources back to your site? My blog is in the very same niche

as yours and my visitors would truly benefit from some of the information you

present here. Please let me know if this alright with you.

Many thanks!

It’s very straightforward to find out any matter on web as

compared to books, as I found this piece of writing at this website.

Hi there just wanted to give you a quick heads up and let you know a few

of the images aren’t loading correctly. I’m not sure why but I think its a linking issue.

I’ve tried it in two different web browsers and both show the same

outcome.

Wow, amazing blog format! How lengthy have

you been blogging for? you made blogging glance easy. The overall glance of your web site is excellent,

as neatly as the content material!

Hi there, i read your blog occasionally and i own a similar one and i was just curious if you

get a lot of spam comments? If so how do you reduce it, any plugin or anything you can suggest?

I get so much lately it’s driving me insane so

any support is very much appreciated.

Undeniably believe that which you stated. Your favorite reason seemed to be at the web the

simplest factor to be mindful of. I say to you, I

definitely get irked while people think about worries

that they plainly don’t understand about.

You managed to hit the nail upon the top as neatly as defined out the entire thing without

having side effect , other people can take a signal.

Will likely be again to get more. Thanks

Highly energetic article, I loved that a lot. Will there be a part 2?

I have read so many content on the topic of the blogger lovers however this article

is truly a fastidious piece of writing, keep it up.

http://mysite.ru

I am regular visitor, how are you everybody? This post posted at

this web page is truly fastidious.

Highly descriptive post, I loved that bit. Will there

be a part 2?

When I originally commented I appear to have clicked the

-Notify me when new comments are added- checkbox and now every time a comment is added I get 4 emails with the exact same comment.

Perhaps there is a means you are able to remove me from that service?

Thank you!

Hi there, I enjoy reading through your article post.

I like to write a little comment to support you.

Hello there! This is my first visit to your blog!

We are a team of volunteers and starting a new project in a community in the same

niche. Your blog provided us valuable information to work on. You have done a outstanding job!

A fascinating discussion is definitely worth

comment. There’s no doubt that that you ought to write more on this topic,

it might not be a taboo subject but typically people

don’t talk about such issues. To the next! All the

best!!

Very descriptive blog, I enjoyed that bit. Will there be

a part 2?

Hmm is anyone else experiencing problems with the pictures on this blog loading?

I’m trying to determine if its a problem on my end or if it’s the blog.

Any responses would be greatly appreciated.

Hi! I know this is kinda off topic nevertheless I’d figured I’d ask.

Would you be interested in trading links or

maybe guest writing a blog post or vice-versa? My blog addresses a lot of the

same topics as yours and I feel we could greatly benefit from each other.

If you might be interested feel free to send me an e-mail.

I look forward to hearing from you! Wonderful blog by the

way!

Hey there! Would you mind if I share your blog with my myspace group?

There’s a lot of folks that I think would really enjoy your content.

Please let me know. Thanks

Thank you, I have recently been searching for information about this subject

for a while and yours is the greatest I’ve discovered so far.

But, what about the conclusion? Are you certain concerning the source?

Hurrah! In the end I got a web site from where I

be able to in fact get useful information concerning my study

and knowledge.

I am actually happy to read this webpage posts which includes plenty of useful data, thanks for providing these information.

Its like you read my mind! You appear to know a lot about this,

like you wrote the book in it or something. I think that you could do with a few pics to drive the message home a little bit, but other than that, this

is fantastic blog. A fantastic read. I’ll definitely be

back.

Thank you for the good writeup. It in fact was a amusement account it.

Look advanced to far added agreeable from you! By the

way, how can we communicate?

Pretty! This has been an extremely wonderful article.

Thanks for supplying this information.

I’m truly enjoying the design and layout of your website.

It’s a very easy on the eyes which makes it much more enjoyable for me to come here and visit more often. Did

you hire out a designer to create your theme?

Great work!

Attractive section of content. I simply stumbled upon your site

and in accession capital to claim that I get actually loved account your blog posts.

Anyway I will be subscribing in your augment or even I

achievement you access consistently quickly.

Excellent goods from you, man. I’ve understand your stuff previous to and you’re just too

fantastic. I really like what you have acquired here, really like what you’re stating and the way in which you say it.

You make it entertaining and you still care for to keep it wise.

I can not wait to read much more from you. This is really a wonderful web site.

First of all I would like to say awesome blog!

I had a quick question which I’d like to ask if you don’t mind.

I was interested to find out how you center yourself and clear your head prior to

writing. I’ve had a difficult time clearing my mind in getting my thoughts out

there. I truly do take pleasure in writing however

it just seems like the first 10 to 15 minutes are lost simply

just trying to figure out how to begin. Any ideas or hints?

Thanks!

Hey I know this is off topic but I was wondering if you knew of any widgets I could add

to my blog that automatically tweet my newest twitter updates.

I’ve been looking for a plug-in like this for quite some time and was hoping maybe you would have some experience with something

like this. Please let me know if you run into anything.

I truly enjoy reading your blog and I look forward

to your new updates.

It’s going to be finish of mine day, but before end I am reading this fantastic

paragraph to increase my knowledge.

Its like you read my mind! You appear to know a lot about this,

like you wrote the book in it or something. I think that you could do with a few pics

to drive the message home a bit, but instead of that, this is great blog.

A great read. I will certainly be back.

What i don’t realize is in reality how you’re no longer really a lot more smartly-appreciated than you

may be right now. You’re so intelligent. You understand thus considerably in the case of this subject,

produced me in my opinion imagine it from a lot of

numerous angles. Its like men and women aren’t fascinated except

it’s one thing to do with Girl gaga! Your personal stuffs nice.

All the time handle it up!

Pretty! This has been an extremely wonderful article. Many thanks for providing this

info.

You’re so cool! I do not believe I have read through a single thing like that before.

So great to discover someone with original thoughts

on this topic. Seriously.. thanks for starting this up. This

site is something that is needed on the web, someone with a bit of originality!

My family members all the time say that I am killing my time here

at web, except I know I am getting familiarity daily by reading thes

pleasant articles or reviews.

Hello to every one, the contents existing at this website are genuinely remarkable for people experience, well,

keep up the nice work fellows.

You ought to be a part of a contest for one of the best blogs online.

I am going to highly recommend this web site!

I am genuinely delighted to read this web site posts which

carries plenty of helpful information, thanks for providing these kinds of statistics.

I just couldn’t go away your site prior to suggesting that I

extremely loved the standard info a person supply for your visitors?

Is going to be back regularly in order to inspect

new posts

Hi there! I’m at work browsing your blog from my new

iphone 3gs! Just wanted to say I love reading your blog and look forward to all your posts!

Carry on the excellent work!

What’s Going down i’m new to this, I stumbled

upon this I have found It positively useful and it has aided me out loads.

I hope to contribute & aid different users like its helped me.

Great job.

Доска бесплатных объявлений

Have you ever considered about adding a little bit more than just your articles?

I mean, what you say is valuable and all. Nevertheless think about if you added some great pictures or videos

to give your posts more, “pop”! Your content is excellent

but with pics and clips, this website could certainly be one of the most beneficial in its field.

Amazing blog!

Hey There. I found your weblog the usage of msn. This is an extremely neatly written article.

I will make sure to bookmark it and return to

learn extra of your helpful information. Thank you

for the post. I’ll certainly comeback.

Howdy superb website! Does running a blog similar to this

take a large amount of work? I’ve very little knowledge of computer programming but I was hoping to start my own blog in the near future.

Anyhow, should you have any recommendations or tips for new blog owners please share.

I know this is off topic however I just wanted to ask. Many thanks!

Wonderful beat ! I wish to apprentice while you amend your website, how could i subscribe for a blog site?

The account helped me a acceptable deal. I had been tiny bit acquainted

of this your broadcast provided bright clear idea

It’s actually a cool and helpful piece of info. I’m happy that you simply shared this useful info with us.

Please keep us informed like this. Thank you for sharing.

Great post! We will be linking to this particularly great post on our site.

Keep up the great writing.

Normally I don’t learn post on blogs, but I would like

to say that this write-up very forced me to check out and do so!

Your writing style has been surprised me. Thank you, very nice post.

Highly descriptive blog, I liked that bit.

Will there be a part 2?

Fantastic beat ! I wish to apprentice while you amend your website,

how could i subscribe for a blog website? The account aided me a acceptable deal.

I had been tiny bit acquainted of this your broadcast provided bright clear concept

Авторская садовая мебель из массива дерева

Hey there! This is my first visit to your blog!

We are a group of volunteers and starting a new project in a

community in the same niche. Your blog provided us valuable information to work on. You have done a marvellous job!

No matter if some one searches for his required thing, thus he/she wants to be available that in detail, so that thing is maintained over here.

Hello! I could have sworn I’ve visited your blog

before but after looking at many of the articles I realized it’s new to me.

Regardless, I’m definitely pleased I stumbled upon it and I’ll

be book-marking it and checking back often!

This is really interesting, You are a very skilled blogger.

I’ve joined your feed and look forward to seeking more of your excellent post.

Also, I’ve shared your website in my social networks!

Paragraph writing is also a fun, if you be familiar with afterward you can write if not it is complex to write.

Do you have a spam problem on this site; I also am a blogger, and I was curious about your situation; we have developed some nice methods and

we are looking to swap strategies with other folks, please shoot me an email if interested.

Today, I went to the beachfront with my children.

I found a sea shell and gave it to my 4 year old daughter and said “You can hear the ocean if you put this to your ear.”

She placed the shell to her ear and screamed. There was a hermit

crab inside and it pinched her ear. She never wants to go back!

LoL I know this is totally off topic but I had to tell someone!

Woah! I’m really digging the template/theme of this website.

It’s simple, yet effective. A lot of times it’s very difficult to get that “perfect balance” between superb usability and visual appearance.

I must say that you’ve done a excellent job with this.

Also, the blog loads very fast for me on Firefox. Superb Blog!

Wow, fantastic blog layout! How long have you been blogging for?